DESCRIPTION OF PROJECT

Brazil and Colombia are biodiversity hotspots whose ecological wealth is at risk (IPBES, 2018). Key impact drivers include, for example, habitat fragmentation and loss. By attracting sufficient funding, promoting and establishing sustainable practices, the conservation and restoration of biodiversity can become compatible with economic prosperity.

In response, both countries have initiated sustainable finance taxonomies, which set standards for scaling up sustainable investments and should facilitate finance in this regard. In Brazil, this refers to the Brazilian Federation of Banks’ (FEBRABAN) green taxonomy. In Colombia, this refers to the taxonomy that is just in the process of development at the national level.

This research and capacity building project focuses on empowering relevant policymakers and financial market actors in the use and application of sustainable finance taxonomies in Brazil and Colombia, considering biodiversity and ecosystems. Additionally, it raises interest in the application of such taxonomies among companies from biodiversity-relevant sectors via practical examples.

Through the knowledge exchange between the target region and the EU, international cooperation will be strengthened to harmonize sustainable finance practices. The project will thus enable a post-COVID-19 recovery in harmony with nature and the achievement of international biodiversity goals.

“Research and capacity building activities for mainstreaming biodiversity for financial operations, this is our goal”

Frankfurt School of Finance and Management gGmbH and more specifically the UNEP Collaborating Centre for Climate & Sustainable Energy Finance is a strategic cooperation on cutting-edge research, policy advice, education and project implementation on sustainable, climate and biodiversity finance with international experience. Frankfurt School brings in its extensive knowledge on the EU Taxonomy and leads the activities related to knowledge exchange, international research and capacity building with European and International focus.

Fondo Acción is a Colombian private fund with more than 20 years of experience in sustainable investments in the environment and childhood protection. In this timeframe, Fondo Acción has invested more than USD 100 billion, created six long-term financial mechanisms, and supported through financial and technical resources more than 1,400 projects.

The Center for Sustainability Studies (FGVces) is a research centre based at Fundação Getulio Vargas School of Administration, in Brazil. Founded in 2003, FGVces has been working on the development of strategies, policies and sustainability management tools for state-owned and private companies at the local, national and international level.

Topics

Sustainable finance / green taxonomies

Nature-positive practices

Data and tools for financial decision-making

Land use impacts and dependencies

Business opportunities

Financing mechanisms (existing and innovative)

Post-2020 CBD Framework (GBF)

Taskforce on nature-related Disclosures (TNFD)

BIOFIN

Other international initiatives

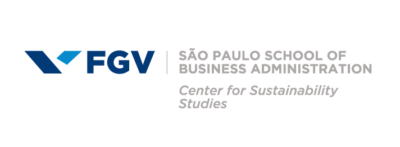

Timeline

A crosscutting line througout the project – capacity building activities and stakeholders consultations/interviews

Webinars 2023

El rol de las instituciones financieras en la promoción de la conservación y el uso sostenible de la biodiversidad

El proyecto Finanzas Sostenibles para la Biodiversidad en Brazil y Colombia (SF4B) a través de sus implementadores Frankfurt School – UNEP Centre (Alemania), Fondo Acción (Colombia) y FGVces – Centro de Estudos em Sustentabilidade (Brasil) en colaboración con la Sustainability Academy del eco.business Fund Development Facility se complace en lanzar un ciclo de seminarios web que le permitirá a los participantes aprender los conceptos básicos sobre finanzas para la biodiversidad, las tendencias globales y regionales en esta temática así como experiencias de instituciones financieras regionales.

- Certificado: Se brindará un certificado de asistencia a quien participe de las cuatro sesiones.

- Idiomas: Todas las sesiones contarán con traducción simultánea español – portugués

- Duración: 60 a 75 minutos

- Período: de agosto a noviembre de 2023

- Público objetivo: Interesados de instituciones financieras y demás grupos de interés

Enlaces de registro: por favor registrarse para cada seminario y guardar en sus calendarios el link que recibirán de Zoom por correo electrónico:

- 1

- 2

- 3

- 4

Explore nuestro archivo de seminarios anteriores

¿No ha asistido a nuestros seminarios anteriores o desea volver a repasar información valiosa? Sumérjase en nuestro archivo de grabaciones de seminarios anteriores. Aquí podrá acceder a un tesoro de conocimientos y experiencia sobre diversos temas.

- 1

- 2

- 3

- 4

News

WEBINAR FS-UNEP CENTRE / SEPTEMBER 2023

WEBINAR FS-UNEP CENTRE / AUGUST 2023

WEBINAR FS-UNEP CENTRE / JULY 2023

FS-UNEP CENTRE / JUNE 2022

Navigating the biodiversity crisis: notes for the financial sector

FS-UNEP CENTRE / 31 MARCH 2022

Reports

March 2024 – Fondo Acción, Colombia – Available in Spanish:

September 2023 – FS-UNEP Collaborating Centre for Climate & Sustainable Energy Finance, Germany – Available in English, Spanish, and Portuguese:

September 2022 – Fondo Acción, Colombia – Available in English, Spanish, and Portuguese:

September 2022 – Fundação Getulio Vargas (FGVces), Brazil:

Prototype, March 2024

Establishing a biodiversity finance framework, or incorporating biodiversity in an existing sustainable finance framework

There are various drivers, including regulations, but also opportunities for economic sectors and the financial sector in relation to aligning with the objectives of the Paris Agreement, the Kunming-Montreal Global Biodiversity Framework, and the Sustainable Development Goals (SDGs).

Financial institutions are increasingly engaging with clients on sustainability, including climate actions.

Collaboratively, they are facilitating net zero efforts. Much more recent, nature-positive actions with the objective to protect and conserve biodiversity moved into the focus.

Sustainable financial instruments are playing hereby an important role, and associated frameworks provide the sustainability criteria that are applied in financing decisions.

Several financial institutions already apply a sustainable finance framework. However, Due to the more recent and ongoing developments related to nature-positive objectives, such frameworks may require a revision (e.g., by updating the use of proceeds and indicators that are used for the reporting).

This document may provide some of the first points for consideration when incorporating biodiversity in existing sustainable finance framework or establishing a new biodiversity finance framework.