Scenario Analysis as a Tool for InvestorS, Firms, and regulators on the path to climate neutralitY

S A T I S F Y

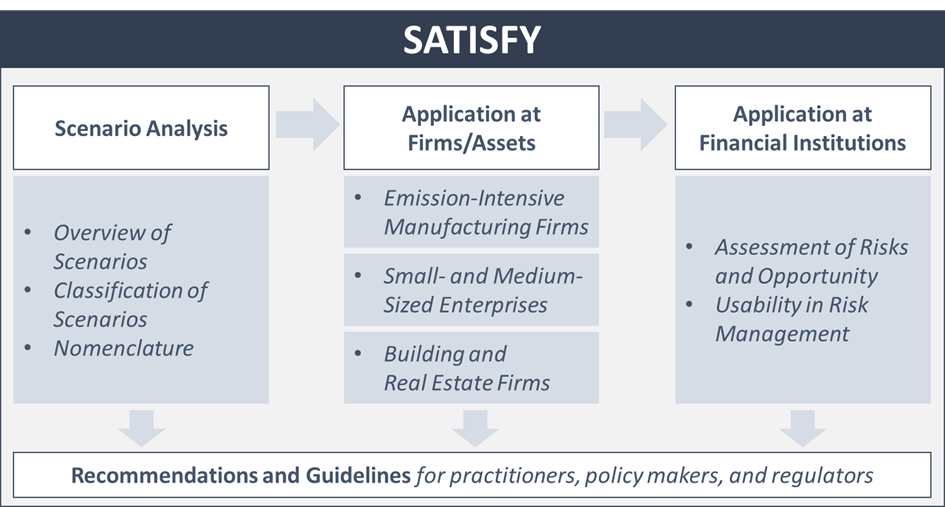

Frankfurt School – UNEP Collaborating Centre, the German Institute for Economic Research, and Justus-Liebig-University Gießen jointly conduct research on scenario analysis as a tool on the path to climate neutrality. The three-year project SATISFY will produce insights into how investors, firms, and regulators can use scenario analysis in the climate transformation of business models in carbon-intensive sectors and the entire economy.

The structural transformation to achieve a climate-neutral economy induces risks and opportunities at the firm and the financial-system-level. Analysing and shaping the transition to a net-zero economy requires a forward-looking perspective. Scenario analysis is an important tool to detect and understand the potential implications of these climate-related structural changes. However, current approaches of applying scenario analyses show several deficiencies. Most importantly, applications developed so far usually employ a top-down assessment of the transitional risks and typically do not reflect the company level.

The project SATISFY will analyse how scenario analysis can serve as a tool to assess, manage, and communicate firm-specific climate risks and opportunities and hence support the transition towards a net-zero economy. The use of scenarios will be analysed for three firm/asset types which are all crucial for the transformation:

- emission-intensive manufacturing firms,

- SMEs, and

- buildings / real estate firms.

Finally, SATISFY will bring the firm/asset level analysis to the financial institution level to understand how the financial sector can assess their risks more adequately.

The project members will produce academic papers, policy briefs, and will invite experts for discussions. Stay tuned!

Publications

Climate scenarios in banks – a case study – October 2023

In this report, we develop and apply a typology that helps banks differentiate climate scenarios based on their characteristics and discuss four use cases. With the increasing importance of climate scenarios for assessing the risks and opportunities of climate change in the financial system, banks face the question of which climate scenarios to select for different use cases.

We review academic and grey literature to develop a typology that helps banks differentiate climate scenarios using a heuristics approach. We differentiate commonly used scenarios based on the typology. We then apply the typology through a case study in a large German promotional bank.

Being the first case study with a bank in this field, the paper adds to the literature by providing a characterization of climate scenarios for banks and by supporting the selection of a climate scenario amongst banks.