Our Tools

Our tools provide easy access to data and information and support decision-making for climate action.

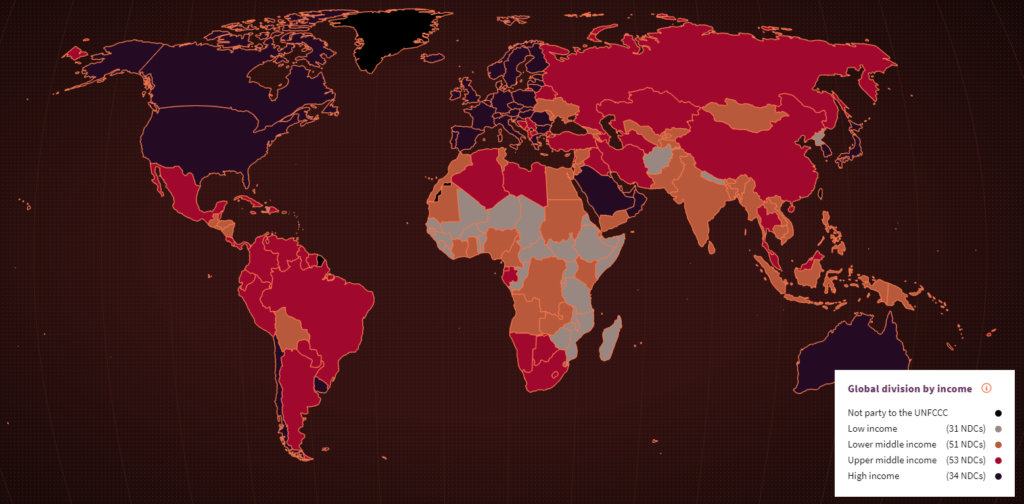

NDC Explorer

The NDC Explorer provides a neutral, sophisticated and user-friendly lens to analyse and compare both qualitative and quantitative (I)NDC content. The NDC Explorer furthermore stimulates the debate on content, scope as well as formulation and implementation processes of the national climate action plans. Its data has been the basis for a variety of publications and also supports policy makers in formulating improved and more ambitious NDCs in 2020 and thereafter.

The development of the NDC Explorer is led by Pieter Pauw (Frankfurt School) and supported by Davide Cassanmagnano (independent consultant), Kennedy Mbeva (ACTS), Jonas Hein, Alejandro Guarin, Clara Brandi (all DIE), Adis Dzebo, Kevin Adams, Aaron Atteridge, Nella Canales (all SEI), Thomas Bock, Joana Helms, Alina Zalewski, Ezra Frommé, Anika Lindener and Dilsham Muhammad (all DIE) as well as colleagues from the UNFCCC secretariat. Sönke Kreft and Eike Behre of the Munich Climate Insurance Initiative (MCII) contributed the subcategory “Climate risk insurance” in October 2017. Guy Cunliffe and Harald Winkler of the Energy Research Centre (ERC) of the University of Cape Town contributed the subcategory “Global temperature target” in October 2018.

The NDC Explorer was financed by the German Federal Ministry for Economic Cooperation and Development (BMZ) and additional financial contributions by the Swedish International Development Cooperation Agency (SIDA) and the Swedish Research Council Formas.

Sustainable Finance Policy Navigator

The time for action on sustainable finance is now. Globally, countries are ramping up efforts to become regional and global leaders in sustainable finance. This requires a well-structured comprehensive yet country-tailored and flexible approach to involve public and private stakeholders in a most efficient way.

The Sustainable Finance Policy Navigator aims to provide an answer to this challenge. It is a comprehensive guidance tool to assist developing and emerging countries in increasing the sustainability in their financial system based on a broad menu of options for taking action.

3fP-Tracker

Financial markets will play a significant role in mitigating climate change. Shifting the trillions towards low-carbon investments is necessary to achieve the Paris climate goals. The financial system needs to consider climate related risks to avoid abrupt price corrections triggered by climate events.

Policy makers have understood those climate-related risks and opportunities for financial markets. Policy initiatives such as the EU Action Plan on Sustainable Finance try to create framework conditions that enable higher market stability and unleash huge potential for the future of a greener planet.

With the finance fit for Paris (3fP) – Tracker, the FS-UNEP Collaborating Centre assesses progress and provides transparency on the path to green financial systems.